What is expense ratio in mutual fund and how it affect our returns?

Expense Ratio

While choosing a mutual fund, you should judge it on various parameters, such as its past performance with respect to its benchmark and category average, its asset allocation pattern and the fund manager’s history. Another common criterion that can help you select a suitable fund is its expense ratio.

The expense ratio is the annual fee that all funds or ETF charge their shareholders. It expresses the percentage of assets deducted each fiscal year for fund expenses, including management fees, administrative fees, operating costs, and all other asset-based costs incurred by the fund.

Portfolio transaction fees, or brokerage costs, as well as initial or deferred sales charges are not included in the expense ratio. The expense ratio, which is deducted from the fund’s average net assets, is accrued on a daily basis.

If the fund’s assets are small, its expense ratio can be quite high because the fund must meet its expenses from a restricted asset base. Conversely, as the net assets of the fund grow, the expense percentage should ideally diminish as expenses are spread across the wider base. Funds may also opt to waive all or a portion of the expenses that make up their overall expense ratio.

- Passive fund usually have lower expense ratio as compare to actively managed funds.

- Mutual fund direct plans have lower expense ratio as compare to regular plan.

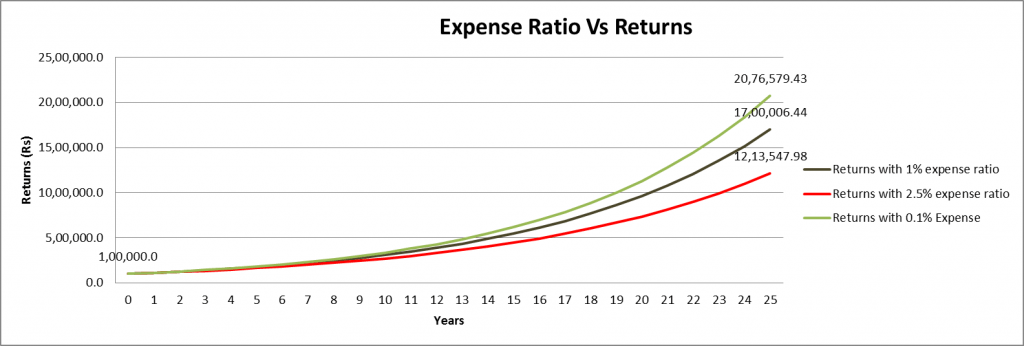

Impact of expense ratio

If you invest Rs 1 lakh in a mutual fund at a NAV of Rs 10 and the expense ratio is 2%, after one year, there is a gain of 12% on the NAV. So, the value of Rs 1 lakh has gone up to Rs 1.12 lakh.

However, after a deduction of 2% charge, the amount is reduced to Rs 1.09 lakh, which translates into a loss of Rs 2,240. Though it does not seem a big reduction, it could impair the value of investments over the long term.